How to Make Car Insurance Cheaper for Young Drivers

Car insurance is often a hefty expense for young drivers, particularly for those with limited driving experience. Since insurance companies view them as higher risk, premiums can be significantly higher compared to more experienced drivers. However, young drivers can reduce these costs in several ways, such as installing vehicle tracking systems, without sacrificing essential coverage.

In this article, we’ll discuss how to make insurance cheaper for young drivers using effective strategies to lower their car insurance premiums. From choosing the right type of coverage to taking advantage of discounts, there are various approaches to make insurance more affordable. By following these tips, young drivers can enjoy both peace of mind and financial savings on their car insurance.

Why is Car Insurance So Expensive for New Drivers?

If you are a new driver, you can anticipate your car insurance to be more expensive, especially for drivers aged 17-20. Car insurance is often more expensive for new drivers due to several factors that insurers consider when determining premiums. As a new driver, especially one who is young or inexperienced, insurance companies view you as a higher risk to insure.

The best way to navigate your way through the world of insurance: understand the factors that contribute to your rates. By doing this, you get a better sense of what your needs are. Then, you can tackle ways of how to find cheap car insurance for new drivers.

Key Factors in New Driver Insurance Rates

Insurance companies use several factors to determine premiums for new drivers. Since they lack a long driving history, insurers assess various risk indicators to set rates. Understanding these key factors can help new drivers make informed choices and potentially lead to ways of how to get cheap new driver insurance.

These are the main elements that influence how much a new driver pays for coverage:

- Age and Experience: Younger drivers and those with little experience typically pay higher premiums due to a higher accident risk. 18-year-olds can now expect to pay average costs of £3,162, an increase of 84% from previous annual averages.

- Driving Record: A clean record with no accidents or violations can lead to lower rates over time.

- Vehicle Type: Cars with high safety ratings and lower repair costs are cheaper to insure than sports or luxury vehicles.

- Coverage Level: Comprehensive and full coverage policies cost more than basic liability insurance.

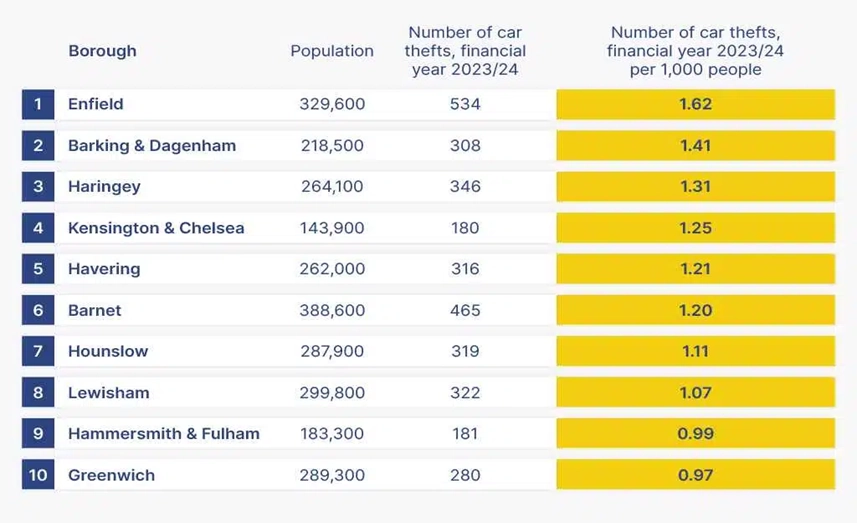

- Location: Living in urban areas or regions with high traffic, high-crime areas or regular traffic violations can increase premiums.

- Annual Mileage: Drivers who use their car less may qualify for lower rates; this is typically around or less than 6,500 miles.

- Credit Score: In some regions, insurers use credit history to determine risk, affecting premiums.

- Policy Add-ons: Extras like roadside assistance or accident forgiveness increase costs.

How Age Affects Car Insurance Costs

Statistically, young male drivers, particularly those under 25, are four times more likely to be in crashes, leading insurers to set higher premiums to account for this increased risk. Insurers also consider younger drivers to have less experience, making them more prone to accidents and claims. As drivers gain more years on the road and build an NCD, their premiums typically decrease, especially after age 25.

The Importance of Vehicle Choice

High-performance or expensive cars often come with higher insurance costs. The best way to determine how your car choice will affect cost is by reviewing Vehicle Risk Ratings in the UK. For each of the below categories, a vehicle receives a Vehicle Risk Rating from one to 100 – with low scores indicating a low risk and higher scores indicating extreme risk.

The five categories of the Vehicle Risk Rating are:

- Performance: Factors such as acceleration, top speed, drivetrains, powertrains and list price contribute to overall performance.

- Damageability: This is determined by how the materials and design of a car affect the severity and cost of potential repairs.

- Repairability: As a new assessment factor, this considers how easily a car can be repaired, using the “transparent and accessible repair strategy”.

- Safety: Overall, safety is scored on the presence of passive and active safety systems, kerb weight and other factors.

- Security: These days, this is based on the vehicle’s designs preventing theft using physical and digital systems.

Maximising Savings on Insurance

To find ways on how to get cheap car insurance for new drivers, it’s essential to shop around and compare quotes from different insurers, as premiums can vary significantly. Additionally, you may consider installing reputable security features, which may lead to further discounts. Four top recommended security enhancements include alarms, trackers, locks and immobilisers.

1.Alarms

In addition to your factory built-in system on your vehicle, adding an advanced car alarm will reinforce your car’s security. An advanced car alarm can offer features like motion sensors, remote activation, and alerts directly to your phone, providing additional layers of protection. These added security measures can not only reduce the risk of theft but also potentially lower your insurance premiums and are rewarded with discounts for cars with enhanced security features.

2.Vehicle Tracking

Installing a vehicle tracking system can significantly improve your car’s security and help lower insurance premiums. These systems allow insurers to track your vehicle’s location in case of theft, increasing the chances of recovery. Many insurers offer discounts for cars equipped with tracking devices, as it reduces the risk of loss and provides peace of mind to both drivers and insurers.

3.Locks

Upgrading your vehicle with van locks can provide an extra layer of security, especially for vans or vehicles used for business purposes. High-quality, reinforced locks are more difficult to bypass and can deter thieves from attempting a break-in. For added protection, consider installing deadlocks or additional security measures like steering wheel locks, as these can further reduce the risk of theft and may result in lower insurance premiums.

4.Immbobiliser

An immobiliser is an essential security feature that prevents a vehicle from starting without the correct key or fob, effectively deterring theft. Most modern vehicles come with factory-installed immobilisers, but adding an aftermarket system can further enhance protection. Insurers often offer discounts for vehicles equipped with advanced technology such as Ghost Immobilisers, as they reduce the likelihood of theft and make it harder for thieves to bypass the security system.

Practical Ways to Lower Insurance Costs

As for ways of how to get cheaper car insurance for new drivers, start by reducing your car insurance premiums. This can be achieved through several practical strategies:

- Drive a Car with a Lower Insurance Group: Opt for vehicles with high safety ratings and low repair costs – you can start by exploring the top 10 safest cars in 2024.

- Consider Telematics Insurance: Use a black box to monitor your driving habits and potentially qualify for lower rates.

- Shop Around for Quotes: Compare policies from different insurers to find the best deal and do your research to ensure you understand car insurance and coverage.

- Increase your Voluntary Excess: Raising the excess can lower your monthly premiums – but make sure you can afford a claim, as young drivers may already pay up to 10% of their income on insurance.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to accumulate an NCD.Fun Fact: As for how much does insurance go down after a year – car insurance can decrease significantly in the UK after one year of claim-free driving, thanks to a No Claims Discount (NCD). The exact reduction or discount reward depends on the insurer, driver profile, and vehicle, but maintaining a clean record generally leads to lower premiums over time, such as:

- 1 Year Without a Claim: Between 5% to 30% off

- 3 Years Without a Claim: About 40% off

- 5 Years Without a Claim: Up to 60% off

Future Considerations for New Drivers

As new drivers gain experience and build a clean driving record, they should consider revisiting their car insurance options to take advantage of lower premiums. Over time, accumulating an NCD can lead to significant savings, making it worthwhile to maintain a claim-free history. Additionally, as your circumstances change, such as if you move to a safer area or upgrade to a more secure vehicle, insurance costs may decrease further, offering ongoing opportunities to reduce premiums and contributing to ways of how to get cheap insurance for a new driver.

FAQs

Why is insurance so expensive for young drivers?

Car insurance tends to be more expensive for young drivers because they are considered high-risk by insurers. Statistics show that they are more likely to experience accidents due to factors like inexperience or overconfidence, risky behaviours such as driving under the influence of alcohol or drugs, or using mobile phones while driving. These increased risks lead insurers to charge higher premiums to compensate for the potential costs of claims.

How to get cheap insurance for young drivers?

To get cheaper car insurance as a young driver, consider choosing a vehicle with a lower insurance group, such as one with good safety ratings and lower repair costs. Building a No Claims Discount (NCD) by maintaining a claim-free driving record can also help reduce premiums over time. Additionally, installing security features like a tracking system or immobiliser, and opting for a higher voluntary excess can further lower your insurance costs.

Share